Looking to invest in the S&P 500 but not sure which fund is right for you? Enter the ring: VOO vs VFIAX. These two heavyweights in the index fund world offer investors a chance to track the performance of America’s top companies. Join us as we break down their similarities, differences, and help you decide which contender will come out on top in your investment journey!

Understanding the S&P 500 Index

The S&P 500 Index is a widely followed benchmark that tracks the performance of 500 large-cap U.

S. stocks across various sectors. It provides investors with a snapshot of the overall stock market and is considered a key indicator of the U.

S. economy’s health.

The companies included in the index are selected based on specific criteria, such as market capitalization, liquidity, and financial viability. This diversification helps reduce risk by spreading investments across different industries.

Investing in an S&P 500 index fund like VOO vs VFIAX offers exposure to some of the biggest and most well-established companies in the U.

S., providing a convenient way for investors to access broad market exposure in a single investment.

Understanding how the S&P 500 Index works can help investors make informed decisions about their investment strategies and asset allocation. By tracking its performance over time, investors can gain insights into market trends and potential opportunities for growth.

Key Similarities and Differences between VOO and VFIAX

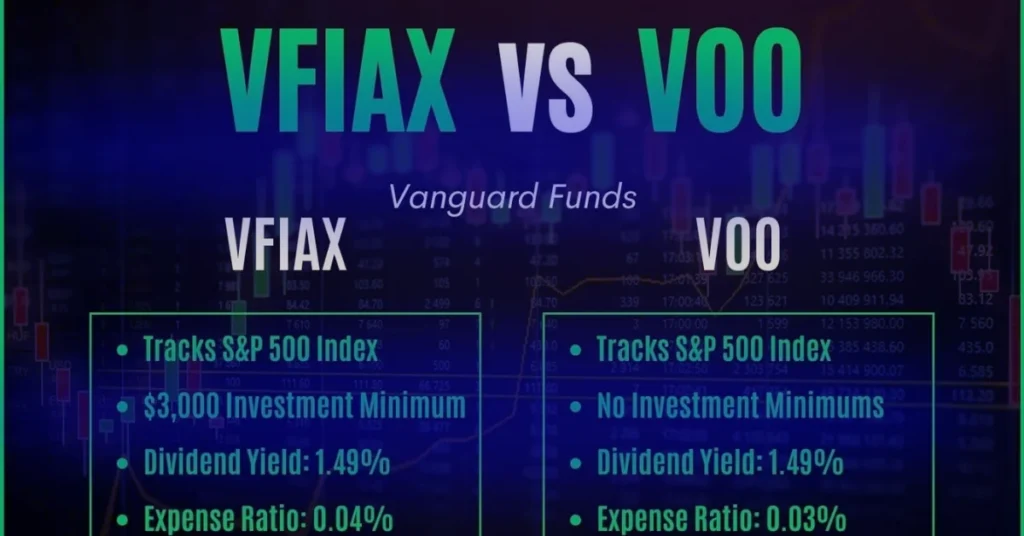

When comparing VOO and VFIAX, it’s essential to understand their key similarities and differences. Both funds aim to track the S&P 500 Index, providing investors exposure to top US companies. However, there are subtle distinctions that set them apart.

One major difference lies in their expense ratios. While both have low fees compared to actively managed funds, VFIAX typically has a slightly lower expense ratio than VOO.

Another factor to consider is the minimum investment requirement. VOO may require a higher initial investment compared to VFIAX, making it potentially less accessible for some investors.

In terms of performance, historical data shows that both funds have closely mirrored the returns of the S&P 500 Index over time. However, slight variations in performance can occur due to factors like tracking error or fund management strategies.

Understanding these nuances can help investors make an informed decision when choosing between VOO and VFIAX for their portfolio.

Performance Comparison of VOO and VFIAX

When it comes to comparing the performance of VOO vs VFIAX, investors often look at factors like returns over time. Both funds aim to track the S&P 500 Index, but slight differences in expense ratios and tracking error can influence how closely they mirror the index’s performance.

Over shorter periods, one fund may outperform the other due to varying factors like market conditions or fees. However, long-term investors typically focus on consistent performance and low expenses when choosing between VOO and VFIAX.

It’s essential to analyze historical data and consider your investment goals before deciding which fund aligns best with your strategy. While past performance is not indicative of future results, understanding how each fund has fared in different market environments can provide valuable insights for potential investors.

Factors to Consider When Choosing Between VOO and VFIAX

When deciding between VOO vs VFIAX, it’s essential to consider your investment goals. Are you looking for long-term growth or immediate returns? Understanding your financial objectives can help guide your choice.

Another factor to weigh is the expense ratio of each fund. Lower expenses mean more of your returns stay in your pocket. Compare the costs associated with VOO and VFIAX to determine which aligns better with your budget.

Consider the historical performance of both funds. Analyze how they have fared in different market conditions and compare their track records over time. This can give you insight into potential future performance.

Additionally, assess the level of risk you are comfortable with. Each fund may have a different risk profile based on its holdings and investment strategy. Make sure to choose a fund that matches your risk tolerance.

Take into account any additional features or benefits offered by each fund, such as dividend reinvestment options or tax implications. These factors can also influence your decision when choosing between VOO and VFIAX.

Pros and Cons of Investing in VOO or VFIAX

Investing in VOO has its perks. With a lower expense ratio compared to VFIAX, it can be a cost-effective option for long-term investors looking to minimize fees. Additionally, VOO allows for intraday trading on the stock market which may appeal to more active traders seeking flexibility in their investments.

On the flip side, VFIAX boasts a longer track record since its inception in 2000, providing investors with historical performance data that spans over two decades. This established history can offer comfort and confidence to those who prefer a more tried-and-tested approach when investing in S&P 500 index funds.

However, one downside of VFIAX is its slightly higher expense ratio compared to VOO, which could eat into potential returns over time. Investors should carefully weigh the trade-offs between cost-efficiency and historical performance when deciding between these two popular investment options.

Conclusion: Which Option is Best for You?

When deciding between VOO and VFIAX, it ultimately comes down to your investment goals, risk tolerance, and personal preferences. Both options provide exposure to the S&P 500 Index and have their own set of advantages and limitations.

If you prefer lower expense ratios and are looking for a slightly higher historical performance track record, VFIAX might be the better choice for you. On the other hand, if you value flexibility in trading throughout the day and want to avoid potential capital gains taxes through ETFs, then VOO could be more suitable for your investment strategy.

Before making a decision, carefully consider these factors along with consulting with a financial advisor who can provide personalized guidance based on your individual circumstances. Remember that both VOO and VFIAX offer efficient ways to invest in large-cap U.

S. stocks through the S&P 500 Index. Choose wisely based on what aligns best with your financial objectives.

FAQs

Q: What are the main differences between VOO and VFIAX?

Ans: VOO is an ETF, while VFIAX is a mutual fund. VOO trades throughout the day on the stock market, whereas VFIAX trades only at the end of the trading day.

Q: How do the expense ratios of VOO and VFIAX compare?

Ans: Both VOO and VFIAX have low expense ratios, but VOO typically has a slightly lower expense ratio compared to VFIAX, making it a more cost-effective option.

Q: Which fund is better for long-term investment: VOO or VFIAX?

Ans: Both funds are excellent for long-term investment as they track the S&P 500 Index. The choice depends on your preference for ETFs versus mutual funds and your investment strategy.

Q: Can I reinvest dividends in VOO and VFIAX?

Ans: Yes, both VOO and VFIAX allow for dividend reinvestment. VFIAX offers automatic dividend reinvestment, while VOO provides this option through a brokerage.

Q: What is the minimum investment required for VOO and VFIAX?

Ans: VOO has no minimum investment requirement as it is purchased in shares, whereas VFIAX typically requires a minimum investment, often around $3,000, making VOO potentially more accessible.